The Data-Funded Grid Ecosystem

Introduction: The Capital Crisis

The global energy grid is facing a trillion-euros paradox. We are racing to electrify everything—from vehicles to heating systems—yet the physical infrastructure (wires, transformers, and substations) is aging and brittle. Traditional funding models are exhausted; utilities can only raise rates so much before political and public backlash ensues.

However, there is a massive, untapped asset sitting in every home and business: Data.

By combining the principles of Decentralized Physical Infrastructure Networks (DePIN) with modern tokenomics, we can unlock the value of this data to create a self-funding grid. This is not science fiction; it is a financial re-engineering of the utility model.

The Core Concept

In the traditional model, the customer is a passive endpoint who pays for electrons. In the DePIN model, the customer is an active node in a digital network.

The premise is simple: Energy usage data—when aggregated, verified, and anonymized—is highly valuable to third parties. By "tokenizing" this data, we create a liquid market where the revenue generated from data sales is funneled directly back into physical infrastructure upgrades.

How the Mechanism Works: The Data-to-Infrastructure Flywheel

The system operates on a cyclical business model often called a "flywheel." It consists of four distinct phases:

Data Generation

Households install blockchain smart meters to the protocol. These devices stream granular, real-time data regarding voltage, frequency, and consumption patterns.

Token Incentivization

In exchange for providing this data, the customer earns a Utility Token (e.g., $EUT). This is the "carrot" that solves the adoption problem. The customer can use these tokens to pay their energy bills, purchase smart home hardware, or trade them on the open market.

Monetization (The Marketplace)

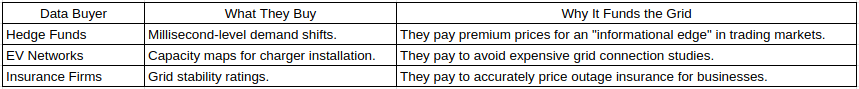

The protocol aggregates this data into high-level insights. It does not sell "John Doe’s laundry schedule"; it sells "aggregated voltage stability metrics for the downtown district." This data is sold via API to high-value buyers:

Grid Operators: Need visibility to balance loads and prevent blackouts.

Energy Traders: Need real-time consumption data to arbitrage spot markets.

Urban Planners: Need historical load data to size infrastructure for new developments.

Infrastructure Funding (The Treasury)

This is the critical step. The revenue from data sales (paid in fiat or stablecoins) is sent to a Smart Treasury.

20% goes to buy back and burn the utility token (supporting the price for customers).

80% is locked into an Infrastructure Fund. This fund issues grants or low-interest loans to upgrade the physical grid—buying new transformers, upgrading substations, or installing neighborhood batteries.

The Economics: Who Pays for What?

To make this sustainable, the value of the data must exceed the cost of the rewards. By capturing value from these external actors, the grid is no longer solely reliant on the ratepayer. The "data layer" subsidizes the "physical layer."

The Dual-Token Structure

To separate the incentive from the governance, a dual-token system is often best:

$EUT (Utility Token): High velocity, used for payments and rewards.

$EGT (Governance Token): Represents a stake in the infrastructure. Holders of $EGT vote on which transformers to upgrade next and earn a portion of the protocol's revenue.

Conclusion

Monetizing energy data via tokenomics transforms the grid from a crumbling liability into a dynamic asset. By turning every meter into a revenue-generating node, we can bridge the infrastructure funding gap. The result is a grid that is not just smarter, but financially self-sovereign—built by the community, funded by data, and powered by renewable energy.